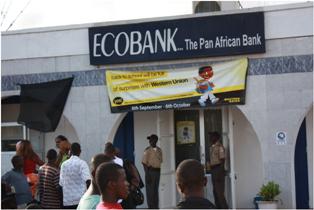

More Troubles At Ecobank

Just at the time ECOBANK is licking its wounds from series of theft that has rocked the bank in recent times through what seems to be an organized syndicate, depositors have began feeling the pinch with many complaining that amounts deposited in their accounts do not reflect.

Just at the time ECOBANK is licking its wounds from series of theft that has rocked the bank in recent times through what seems to be an organized syndicate, depositors have began feeling the pinch with many complaining that amounts deposited in their accounts do not reflect.

The Sinkor Branch of ECOBANK was the scene of one classic case of how members of this apparent “organized syndicate” have siphoned money out of the bank treasury Thursday, when two ladies walked in complaining of how they made a deposit on September 17, last month in an amount of US695.85 as tuition payment for their nephews but said amount never reflected in to the school’s account.

This reporter who was at the bank on Thursday at about 11:30-12:15, saw the two ladies being accompanied by an auditor of the bank to the Sinkor’s branch supervisor as to whether he knew about the said transaction while holding the deposit slip upwards.

This was after the auditor had verified upstairs and recognized the stamps and signatures on the deposit slip to be that of the Sinkor’s branch and did not see it being reflected in the said account on that fateful day.

The supervisor who was on the phone when the two ladies, one of whom is known by this reporter, were accompanied by the auditor to his desk, the supervisor of the ECOBANK Sinkor’s branch could not hold back but said “this is one of the things we are investigating.”

The supervisor then turned to the two ladies and said that the said amount would have been credited to the account yesterday, apparently to avoid another publication in the media.

[bsa_pro_ad_space id=1]

The drama demonstrated how the bank may be secretly crediting some of these accounts quietly on a daily basis. Documents in the possession of this paper indicate that on September 17, 2010, the said amount was deposited into a school’s account (name withheld) as payment for tuition fees and books.

But when the school, went to collect its statement for the said month, it was noticed that the deposit on September 17, did not reflect. The school authorities then called the parent asking whether the said amount was deposited in a foreign check.

This development follows a theft case at the bank’s office in Paynesville and the one at the Central office for which a reporter of this paper was arbitrary jailed upon the orders of the bank’s Public Relations Officer Garrison Barh for taking a photo of the bank’s head office.